is maine tax friendly to retirees

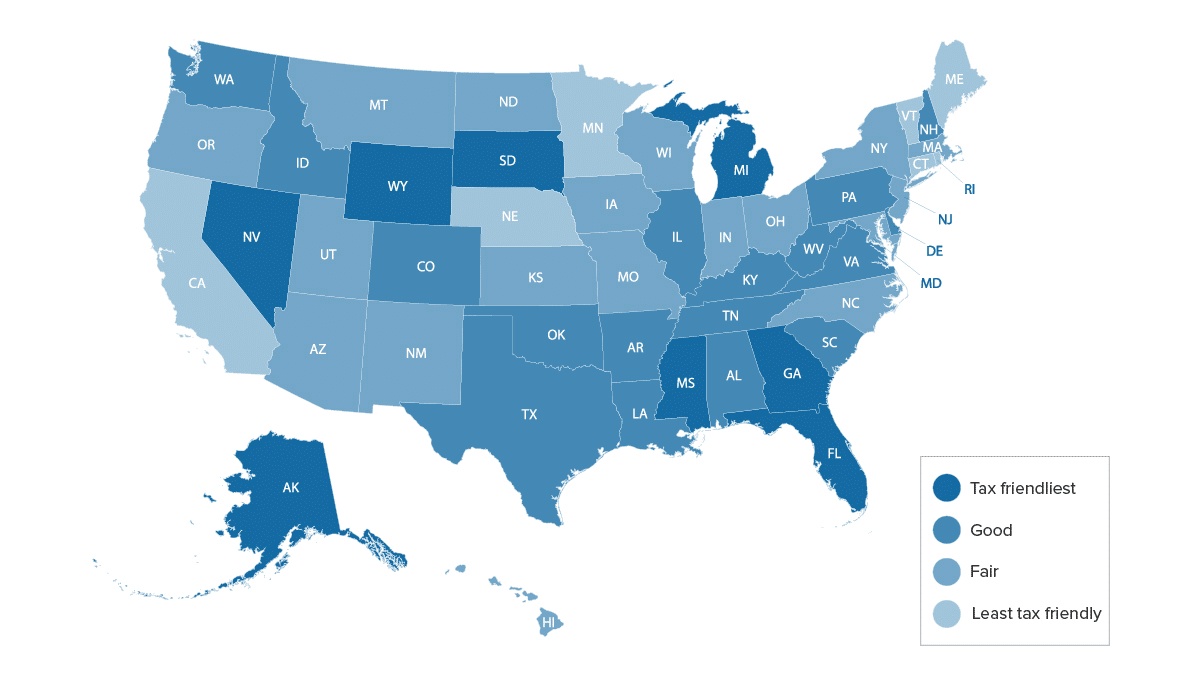

Colorado - Military retirees ages under age 55 can exclude up to 10000 of their retirement pay from their gross income. Also check out the tax-specific slideshows listed below the map including our picks for the 10 most tax-friendly and the 10 least tax-friendly states in the US.

Most Tax Friendly States For Retirees Ranked Goodlife

The President of the United States is elected indirectly.

. It is our honor to serve you. Connecticut Delaware Georgia Maine Maryland Massachusetts New Hampshire New Jersey New York North Carolina Ohio Pennsylvania Rhode Island South Carolina Vermont Virginia West Virginia. Is still dealing with the COVID-19 pandemic which has killed more people than the Civil War did.

The state taxes income from retirement accounts and from pensions such as from MainePERS. Social Security income tax breaks if AGI is 4300058000 or less. No Social Security tax.

In fact Maine is one of the few states with most veterans per capita. There may be a silver lining though. Seniors who receive retirement income from a 401k IRA or pension will pay tax rates as high as 715 though a small deduction is available.

Thankfully things are starting to get closer to normality due to the distribution of vaccines and states have been able to remove. See veterans benefits for all 50 states. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire.

Is Maine tax-friendly for retirees. Though sales taxes can be steep due to local parish and jurisdiction sales taxes food and medications are exempt from sales. By contacting our office you understand and acknowledge this possibility and authorize the Maine Bureau of Veterans Services to work on your behalf.

State Individual Income Tax Rates and Brackets for 2020 Colorado Department of Revenue. For beneficiaries of federal civil service employees or retirees see Pub. The Louisiana LA state sales tax rate is currently 445.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. The state does not tax Social Security income and it also provides a 10000 deduction for retirement income. 1 Best Places to Live in MaineCape Elizabeth.

On the fiscal side Marylands Governor Hogan is implementing the largest tax relief package in the states history providing more than 46 billion in tax relief to a broad swath of the population including families small businesses and retirees as well as increasing the states Rainy-Day Fund. Check the box on top of Form 1040 or 1040-SR on your tax return. The southern locales include the Sun Belt and Hawaii in the United States as well as Mexico and the CaribbeanSnowbirds used to primarily be retired or older but are increasingly of all ages.

Pension and Annuity Subtraction Page 2. 721 Tax Guide to US. The president and a number of other positions such as tax assessor or coroner.

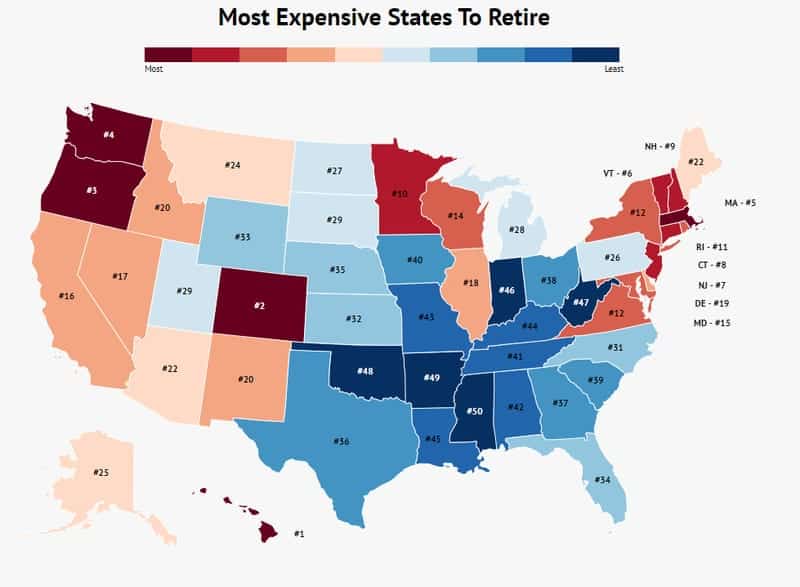

It is easier to see why Maine is a dream retirement destination for many people including military retirees. South Carolina Military retirees with a minimum of 20 years of active duty may exempt up to 3000 until age 65 after which an exemption of 10000 applies. Kiplinger calls it the least-tax-friendly state for retirees.

Conversely a sunbird is one who leaves warmer. The Granite State ranks as one of the most tax-friendly states for retirees and doesnt tax retirement income and social security benefits. Current Resident says Scenic and amazing community.

10000 of some pension income deductible. The high quality of. To fulfill your request the Maine Bureau of Veterans Services may require the need to contact State and Federal agencies on your behalf.

For example the US. No tax on Social Security benefits. After spending nearly 10 years helping big businesses save money in his role as a tax adviser he launched Money Done Right with a mission to help everybody from college students to retirees make more money save more money and grow more money.

Logan Allec is a CPA and owner of the personal finance blog Money Done Right. As military personnel retire whether they faced active combat or not they may find it difficult to readjust to civilian life. Maine Relative tax burden.

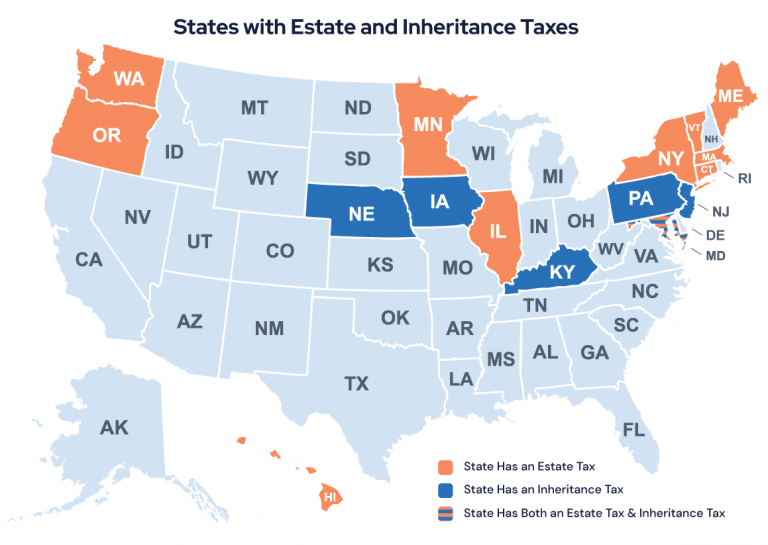

If a person other than the decedents spouse inherits the decedents traditional IRA or Roth IRA that person. States With No Income Tax Eight states dont impose an income tax on earned income as of 2021. State of Connecticut Department of Revenue Services.

Civil Service Retirement Benefits. The weather is always perfect. Not too hot not too cold - as long as youre not visiting.

The people are amazingly friendly and the fresh air is to die for. A snowbird is a person who migrates from the colder northern parts of North America to warmer southern locales typically during the winter. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

Suburb in Maine22 Niche users give it an average review of 43 stars. Depending on local municipalities the total tax rate can be as high as 1145. Those ages 55 - 64 can exclude up to 20000 and those 65 and over can.

Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees. Wolters Kluwer Outlines State Tax Considerations for Retirees Tax Foundation. Social Security is exempt from taxation in Maine but other forms of retirement income are not.

To see what type of tax breaks your state offers for military members retirees and survivors check out our list. Tax codes vary from state to state and tax laws are subject to. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees.

See our Tax Map for.

Best States To Retired In With The Lowest Cost Of Living Finance 101

Maine Retirement Tax Friendliness Smartasset

7 States That Do Not Tax Retirement Income

A Guide To The Best And Worst States To Retire In

A Guide To The Best And Worst States To Retire In

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Most Tax Friendly States For Retirees Ranked Goodlife

A Guide To The Best And Worst States To Retire In

Maine Retirement Tax Friendliness Smartasset

Least Tax Friendly States For Retirement Kiplinger S Personal Finance 03 17 14 Skloff Financial Group

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

Vermont Among Least Tax Friendly States Vermont Business Magazine

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Best States To Live In Retirement

Maine Retirement Tax Friendliness Smartasset

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Most Tax Friendly States For Retirees Ranked Goodlife